Introduction

Financial freedom is a goal that many strive for but few achieve. It’s the state of having enough income to cover your living expenses for the rest of your life without having to be employed or dependent on others. This comprehensive guide reveals expert strategies to unlock financial freedom, covering various aspects of personal finance, investment, and a wealth management.

Understanding Financial Freedom

Definition of Financial Freedom

Financial freedom means different things to different people. For some, it’s about being debt-free, while for others, it’s about having the freedom to pursue passions without worrying about money.

Importance of Financial Freedom

Achieving financial freedom provides security and peace of mind. It allows you to live life on your terms, make choices that align with your values, and provides a cushion against life’s uncertainties.

Myths About Financial Freedom

There are many misconceptions about financial freedom, such as it being only for the wealthy or requiring extreme frugality. Understanding these myths can help you focus on realistic strategies.

Assessing Your Financial Situation

Creating a Financial Inventory

Begin by listing all your assets, liabilities, income, and expenses. This will give you a clear picture of your current financial situation.

Understanding Cash Flow

Cash flow is the movement of money in and out of your accounts. Positive cash flow is essential for building wealth.

Analyzing Debt

Identify all your debts and understand their terms. High-interest debts should be prioritized for repayment.

Setting Financial Goals

Short-Term Goals

These are goals you aim to achieve within a year, such as building an emergency fund or paying off a credit card.

Medium-Term Goals

These goals span one to five years and might include saving for a down payment on a house or buying a car.

Long-Term Goals

Long-term goals are those you plan to achieve in five or more years, such as retirement savings or funding a child’s education.

Budgeting Strategies

Creating a Budget

A budget helps you manage your money by allocating income towards expenses, savings, and investments.

Types of Budgeting Methods

- Zero-Based Budgeting: Allocates every dollar to a specific purpose until none is left.

- 50/30/20 Rule: Allocates 50% to needs, 30% to wants, and 20% to savings.

- Envelope System: Uses envelopes to control spending in different categories.

Tracking Your Spending

Use tools and apps to track your expenses and ensure you stay within your budget.

Saving Strategies

Building an Emergency Fund

An emergency fund is crucial for financial security. Aim to save 3-6 months’ worth of living expenses.

High-Interest Savings Accounts

These accounts offer better returns on your savings compared to regular savings accounts.

Automating Savings

Set up automatic transfers to your savings accounts to ensure you consistently save money.

Debt Management

Understanding Good vs. Bad Debt

Good debt, like a mortgage, can help build wealth, while bad debt, such as high-interest credit cards, can hinder financial progress.

Debt Repayment Strategies

- Debt Snowball Method: Pay off the smallest debts first to build momentum.

- Debt Avalanche Method: Pay off debts with the highest interest rates first to save money on interest.

Consolidating Debt

Debt consolidation can simplify your payments and potentially lower your interest rates.

Investment Basics

Understanding Investment Options

- Stocks: Shares in a company that can provide dividends and capital appreciation.

- Bonds: Loans to governments or corporations that pay interest.

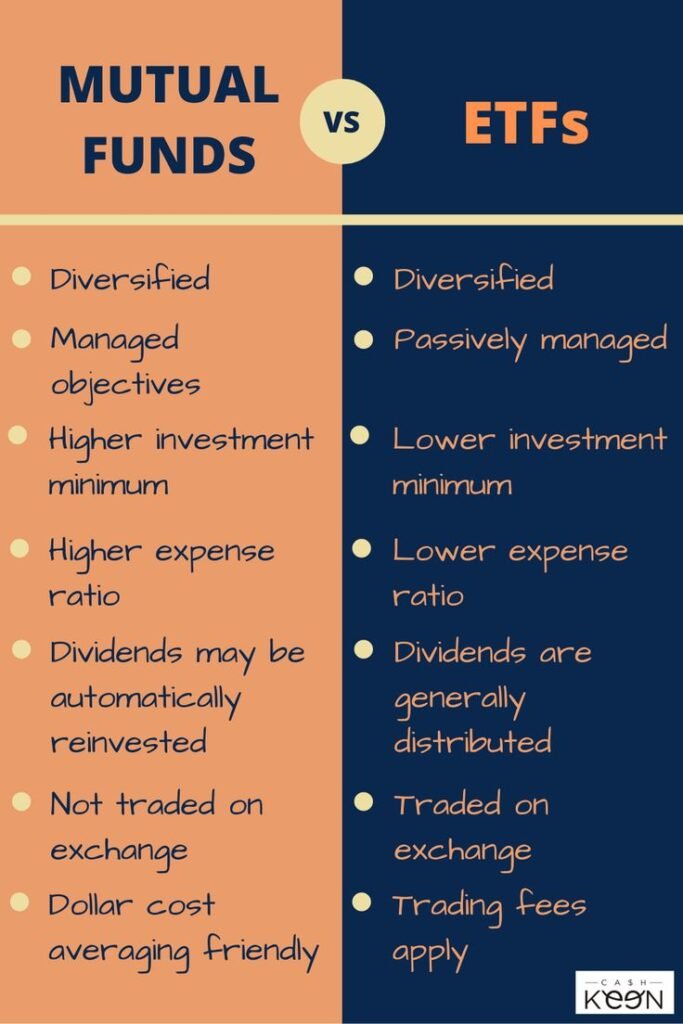

- Mutual Funds: Pooled investments managed by professionals.

- Real Estate: Property investments that can generate rental income and appreciate in value.

Risk and Return

Higher potential returns usually come with higher risks. Understanding your risk tolerance is crucial.

Diversification

Spreading your investments across various asset classes can reduce risk.

Advanced Investment Strategies

Stock Market Investing

Investing in the stock market can provide significant returns but requires knowledge and discipline.

Real Estate Investing

Real estate can offer steady income and tax benefits but requires substantial capital and management.

Passive Income Streams

Creating passive income streams, such as rental properties or dividend-paying stocks, can help achieve financial freedom.

Retirement Planning

Importance of Early Planning

The earlier you start saving for retirement, the more you can benefit from compound interest.

Types of Retirement Accounts

- 401(k): Employer-sponsored plans with tax benefits.

- IRA: Individual Retirement Accounts with tax advantages.

Social Security and Pensions

Understand how these can supplement your retirement income.

Tax Strategies

Tax-Deferred Accounts

Accounts like 401(k)s and IRAs allow you to defer taxes on your contributions until withdrawal.

Tax-Efficient Investing

Strategies to minimize taxes on your investments, such as using tax-loss harvesting.

Working with a Tax Professional

A tax professional can help you optimize your tax strategy and stay compliant with tax laws.

Insurance and Risk Management

Types of Insurance

- Health Insurance: Covers medical expenses.

- Life Insurance: Provides financial support to your dependents.

- Disability Insurance: Replaces income if you become unable to work.

Importance of Insurance

Insurance protects against unforeseen financial losses and provides peace of mind.

Evaluating Insurance Needs

Assess your needs based on your lifestyle, family situation, and financial goals.

Estate Planning

Importance of Estate Planning

Estate planning ensures your assets are distributed according to your wishes and can minimize estate taxes.

Creating a Will

A will specifies how your assets should be distributed after your death.

Trusts and Beneficiaries

Trusts can provide more control over how your assets are managed and distributed.

Building Wealth

Increasing Income

Strategies to increase your income, such as advancing your career, starting a side business, or investing in education.

Reducing Expenses

Cutting unnecessary expenses can free up more money for saving and investing.

Smart Spending

Prioritize spending on things that matter most to you and provide long-term value.

Financial Independence and Early Retirement (FIRE)

Understanding FIRE

The FIRE movement involves saving and investing aggressively to retire early.

Strategies for Achieving FIRE

- High Savings Rate: Save 50% or more of your income.

- Frugal Living: Minimize expenses to maximize savings.

- Smart Investing: Invest in assets that generate passive income.

Challenges of FIRE

Living frugally and maintaining discipline can be challenging but rewarding.

Education and Self-Improvement

Importance of Financial Education

Continuous learning about personal finance is crucial for making informed decisions.

Resources for Learning

Books, courses, and online resources can help you stay informed.

Personal Development

Improving your skills and knowledge can lead to better job opportunities and higher income.

Common Financial Mistakes

Living Beyond Your Means

Spending more than you earn can lead to debt and financial stress.

Not Having a Plan

Without a financial plan, it’s difficult to achieve your goals.

Ignoring Retirement Savings

Delaying retirement savings can result in insufficient funds later in life.

Expert Insights

Financial Advisor’s Role

A financial advisor can provide personalized advice and help you create a comprehensive financial plan.

Choosing the Right Advisor

Look for advisors with proper credentials and a good reputation.

Real-Life Case Studies

Learn from the experiences of others who have achieved financial freedom.

Conclusion

Recap of Key Points

Achieving financial freedom requires a combination of disciplined saving, smart investing, and continuous learning.

Call to Action

Start your journey towards financial freedom today by setting clear goals and taking actionable steps.

4 thoughts on “Unlock Financial Freedom: Expert Finance Strategies Revealed2024”