Introduction

Reverse mortgages can be a valuable financial tool for seniors looking to leverage their home equity without selling their property. However, choosing the right reverse mortgage company is crucial for ensuring favorable terms and reliable service. This guide explores the top reverse mortgage companies in the USA, providing detailed insights to help you make an informed decision.

Content

Reverse mortgages have become increasingly popular among seniors seeking to convert their home equity into cash while remaining in their homes. This financial product can provide much-needed funds for retirees, but the success of a reverse mortgage heavily depends on choosing the right provider. This guide aims to help you navigate the selection process by reviewing the top reverse mortgage companies in the USA.

Understanding Reverse Mortgages

Definition

A reverse mortgage is a loan available to homeowners aged 62 and older that allows them to convert part of the equity in their homes into cash. Unlike a traditional mortgage, where the homeowner makes monthly payments to the lender, a reverse mortgage provides the homeowner with payments, which can be in the form of a lump sum, monthly payments, and line of credit.

How It Works

In a reverse mortgage, the lender makes payments to the homeowner based on a percentage of the home’s value. The homeowner’s debt increases over time as they receive payments, and interest is added to the balance. The credit is reimbursed when the property holder sells the home, moves out, or dies.

Eligibility Criteria

To qualify for a reverse mortgage, homeowners must meet several criteria:

- Be at least 62 years old

- The credit is reimbursed when the mortgage holder sells the home, moves out, or dies.

- Live in the home as their primary residence

- Meet financial assessment requirements to ensure the ability to maintain the property

Types of Reverse Mortgages

Home Equity Conversion Mortgages (HECMs)

HECMs are the most widely recognized sort of graduated home buyback and are safeguarded by the Government Lodging Organization (FHA). They accompany a few shopper insurances, remembering required guiding meetings and cutoff points for charges.

Proprietary Reverse Mortgages

Exclusive graduated home buybacks are private advances presented by individual organizations. They are not insured by the FHA but may offer higher loan amounts for high-value homes.

Single-Purpose Reverse Mortgages

These advances are presented by a few state and neighborhood government offices and charitable associations. They are designed for a specific purpose, such as home repairs or property taxes, and typically have lower costs and fees.

Top Reverse Mortgage Companies in the USA

Criteria for Selection

The companies selected in this guide were chosen based on their reputation, customer reviews, range of services, and compliance with regulatory standards.

Overview of Top Companies

- American Advisors Group (AAG)

- Finance of America Reverse (FAR)

- Liberty Reverse Mortgage

- Reverse Mortgage Funding LLC (RMF)

- Longbridge Financial

- One Reverse Mortgage

- Mutual of Omaha Mortgage

American Advisors Group (AAG)

Company Background

AAG is one of the largest reverse mortgage lenders in the USA, known for its extensive advertising and strong brand presence. Founded in 2004, AAG focuses exclusively on reverse mortgages and offers a range of products to suit different needs.

Services Offered

AAG provides HECMs, proprietary reverse mortgages, and reverse mortgage refinancing. They also offer educational resources and customer support to help clients understand their options.

Customer Reviews

Customers generally praise AAG for its knowledgeable staff and comprehensive service. However, some reviews mention high fees and aggressive marketing tactics.

Finance of America Reverse (FAR)

Company Background

FAR is a subsidiary of Finance of America Companies and has been a major player in the reverse mortgage market since its founding in 2003. The company is known for its innovation and customer-centric approach.

Services Offered

FAR offers HECMs, proprietary reverse mortgages, and a unique product called the HomeSafe® reverse mortgage, which caters to high-value homes. They also provide online tools and resources for prospective borrowers.

Customer Reviews

FAR receives high marks for its customer service and product variety. Some customers have noted the company’s transparent communication and efficient loan processing.

Liberty Reverse Mortgage

Company Background

Liberty Reverse Mortgage, part of the Ocwen Financial Corporation, has been in the reverse mortgage business since 2004. The company emphasizes simplicity and customer education.

Services Offered

Liberty offers HECMs and proprietary reverse mortgages. They focus on providing straightforward information and a streamlined application process.

Customer Reviews

Liberty is appreciated for its user-friendly approach and helpful customer service. Some reviewers have noted the company’s efforts to simplify complex information.

Reverse Mortgage Funding LLC (RMF)

Company Background

RMF was founded in 2012 and quickly established itself as a reputable reverse mortgage lender. The company is known for its customer-first philosophy and robust educational resources.

Services Offered

RMF offers a range of reverse mortgage products, including HECMs, proprietary loans, and reverse mortgage refinancing. They also provide tools to help seniors assess their financial situation.

Customer Reviews

RMF is frequently praised for its supportive customer service and educational focus. Some customers have mentioned the company’s thoroughness in explaining loan options.

Longbridge Financial

Company Background

Longbridge Financial is a newer entrant in the reverse mortgage market, founded in 2012. Despite its relative youth, the company has quickly gained a reputation for its commitment to customer service.

Services Offered

Longbridge offers HECMs and proprietary reverse mortgages. They emphasize personalized service and provide a variety of resources to help seniors understand their choices.

Customer Reviews

Longbridge receives high ratings for its attentive and personalized customer service. Clients appreciate the company’s transparency and thorough explanations.

One Reverse Mortgage

Company Background

One Reverse Mortgage is a subsidiary of Quicken Loans, leveraging the parent company’s strong financial backing and technological expertise. Established in 2001, the company is known for its efficient processes and customer service.

Services Offered

One Reverse Mortgage offers HECMs and reverse mortgage refinancing. They use advanced technology to streamline the application and approval process.

Customer Reviews

Customers often highlight One Reverse Mortgage’s quick processing times and responsive service. Some reviews mention the ease of navigating their online portal.

Mutual of Omaha Mortgage

Company Background

Mutual of Omaha Mortgage, a subsidiary of the well-known insurance company, entered the reverse mortgage market to provide trusted financial products to seniors. The company benefits from its parent’s long-standing reputation.

Services Offered

Mutual of Omaha Mortgage offers HECMs and proprietary reverse mortgages. They provide a range of resources to educate potential borrowers.

Customer Reviews

Mutual of Omaha Mortgage is appreciated for its trustworthy reputation and helpful customer service. Customers often note the company’s reliability and supportive staff.

Expert Insights on Choosing a Reverse Mortgage Company

Tips from Financial Advisors

Financial advisors recommend considering several factors when choosing a reverse mortgage company, including the company’s reputation, customer reviews, and the range of products offered. It’s also important to compare fees and interest rates.

Red Flags to Watch For

Be wary of companies that pressure you into a decision, charge high upfront fees, or lack transparency in their terms and conditions. Always ensure that the company complies with HUD guidelines and other regulatory standards.

Customer Experiences and Testimonials

Positive Experiences

Many customers report positive experiences with reverse mortgage companies, highlighting factors such as helpful customer service, clear communication, and the financial relief provided by the loans.

Challenges Faced

Some customers have faced challenges, including high fees, complex terms, and misunderstandings about the loan’s impact on their estate. It’s crucial to thoroughly understand the terms before proceeding.

Comparative Analysis of Top Companies

Service Quality

Service quality varies among companies, with some offering more personalized and supportive experiences. Companies like AAG and FAR are noted for their comprehensive service, while others may excel in specific areas like online tools.

Loan Options

The availability of different loan options, such as HECMs and proprietary reverse mortgages, is a key differentiator. Some companies, like FAR, offer unique products for high-value homes.

Fees and Costs

Fees and costs can vary significantly. It’s important to compare these aspects across companies to ensure you get the best deal. Some companies are more transparent about their fees, while others may have hidden costs.

Common Questions About Reverse Mortgages

How Much Can I Borrow?

The sum you can acquire relies upon a few elements, including your age, the worth of your home, and current financing costs. Typically, older borrowers with higher-value homes can borrow more.

What Are the Interest Rates?

Loan fees for graduated home buybacks can be fixed or variable. Rates are influenced by market conditions and the type of reverse mortgage you choose. It’s important to compare rates from different lenders.

What Happens If I Outlive the Loan?

If you outlive the loan, you do not have to repay it as long as you continue to live in the home, maintain the property, and pay property taxes and insurance. The advance is reimbursed when you sell the home, move out, or die.

Benefits of Reverse Mortgages

Financial Security

Reverse mortgages provide financial security by converting home equity into cash without requiring monthly mortgage payments. This can help cover living expenses, medical bills, or other needs.

Flexibility

The funds from a reverse mortgage can be received in various ways, such as a lump sum, monthly payments, or a line of credit, providing flexibility to meet different financial needs.

No Monthly Mortgage Payments

One of the biggest advantages is that there are no monthly mortgage payments. The loan is repaid when the home is sold, which can alleviate financial stress for seniors on a fixed income.

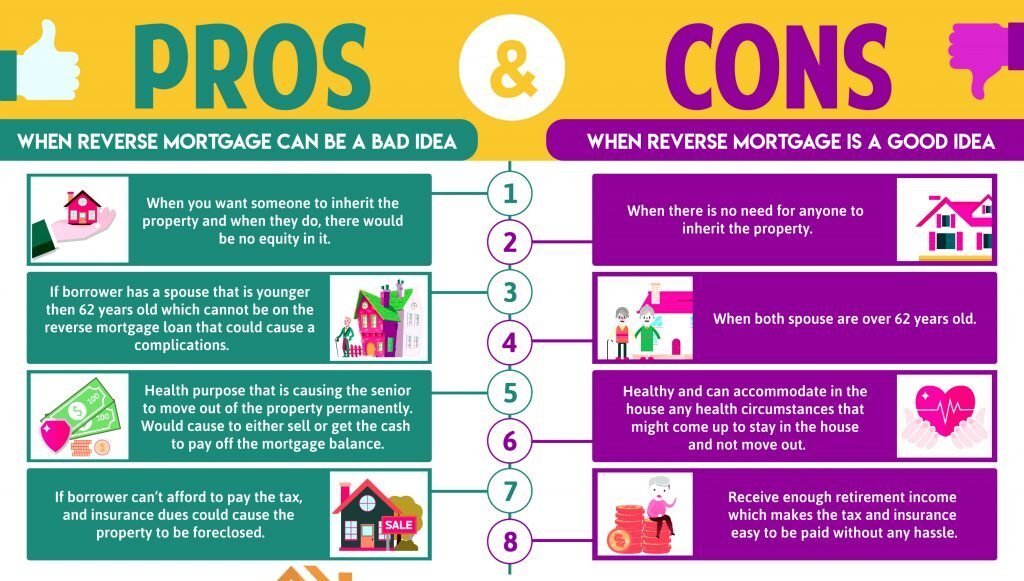

Drawbacks of Reverse Mortgages

Accumulating Interest

Interest on a reverse mortgage accumulates over time, increasing the loan balance. This can reduce the amount of equity left in the home and impact the inheritance left to heirs.

Potential Impact on Inheritance

Since the loan is repaid from the sale of the home, there may be little or no equity left for heirs. It’s important to consider the impact on your estate and discuss it with your family.

Fees and Closing Costs

Reverse mortgages come with various fees and closing costs, which can be higher than those for traditional mortgages. These costs can include origination fees, mortgage insurance premiums, and servicing fees.

Eligibility and Application Process

Steps to Qualify

To qualify for a reverse mortgage, you must meet the age requirement (62 years or older), own your home outright or have a low mortgage balance, live in the home as your primary residence, and pass a financial assessment.

Required Documentation

You’ll need to provide several documents during the application process, including proof of age, homeownership, residency, and financial stability. This can incorporate expense forms, bank articulations, and evidence of protection.

Application Process

The application process involves several steps: counseling with a HUD-approved advisor, submitting an application, undergoing a financial assessment, and closing the loan. Each step ensures that you understand the terms and can meet the obligations of the loan.

Understanding Reverse Mortgage Terms and Conditions

Interest Rates

Interest rates can be fixed or variable. Fixed rates remain the same throughout the life of the loan, while variable rates can change based on market conditions. Understanding how rates work is crucial for managing costs.

Repayment Terms

The loan is typically repaid when the home is sold, the homeowner moves out, or passes away. Repayment terms can vary, so it’s important to understand your obligations and options.

Loan Limits

Loan limits are determined by factors such as the home’s value, the homeowner’s age, and current interest rates. FHA-insured HECMs have maximum lending limits, which can impact the amount you can borrow.

Legal and Regulatory Considerations

HUD Guidelines

HUD guidelines provide consumer protections for HECM borrowers, including mandatory counseling and limits on fees. These guidelines are designed to ensure that borrowers understand the terms and can make informed decisions.

Consumer Protection Laws

Various consumer protection laws apply to reverse mortgages, ensuring transparency and fairness in lending practices. These laws help protect seniors from predatory lending practices.

State-Specific Regulations

State-specific regulations can impact reverse mortgage terms and conditions. It’s important to be aware of any additional requirements or protections in your state.

Alternatives to Reverse Mortgages

Home Equity Loans

Home equity loans allow you to borrow against your home’s equity but require monthly repayments. They can be a good alternative if you need a lump sum and can manage the payments.

HELOCs

Home Equity Lines of Credit (HELOCs) offer a flexible borrowing option, allowing you to draw funds as needed. Like home equity loans, they require monthly repayments.

Downsizing

Selling your home and moving to a smaller, less expensive property can provide financial relief without the complexities of a reverse mortgage. This choice additionally permits you to get to the value in your home.

Financial Planning and Reverse Mortgages

Integrating into Retirement Planning

A reverse mortgage can be a valuable part of a comprehensive retirement plan, providing additional funds to cover expenses and improve your quality of life. It’s important to work with a financial advisor to ensure it fits your overall strategy.

Budgeting with a Reverse Mortgage

Budgeting is crucial when you have a reverse mortgage. Consider all potential costs, including maintenance, property taxes, and insurance, to ensure you can sustain homeownership.

Long-Term Financial Health

Using a reverse mortgage responsibly can help maintain your long-term financial health. It’s important to consider the impact on your estate and make plans for potential future needs.

Future of Reverse Mortgages

Market Trends

The reverse mortgage market is evolving, with new products and innovations making them more attractive and accessible. Remaining informed about market patterns can assist you with settling on better choices.

Technological Advancements

Technology is improving the reverse mortgage process, making it easier to apply and manage your loan. Online tools and resources can provide valuable support.

Legislative Changes

Legislative changes can impact reverse mortgage terms and protections. It’s important to stay informed about potential changes that could affect your loan.

Conclusion

Choosing the right reverse mortgage company is essential for maximizing the benefits and minimizing the drawbacks of a reverse mortgage. By understanding the different types of reverse mortgages, evaluating top companies, and considering expert insights, you can make an informed decision that supports your financial goals.

FAQs

- Might I at any point Lose My Home with a House buyback?

- However long you meet the advance commitments, for example, settling local charges and protection and keeping up with the home, you can’t lose your home. Nonetheless, neglecting to meet these commitments can prompt dispossession.

- How Do I Receive the Money?

- You can receive the money from a reverse mortgage in several ways: a lump sum, monthly payments, a line of credit, or a combination of these options. The choice depends on your financial needs and preferences.

- What If I Want to Sell My Home?

- If you decide to sell your home, you can use the proceeds to repay the reverse mortgage. Any excess value subsequent to reimbursing the advance has a place with you or your beneficiaries.

2 thoughts on “Top Reverse Mortgage Companies in the USA:2024”