here’s a Citi charge card intended for you. This survey will assist you with understanding the highlights and advantages of probably the most famous Citi Visas, so you can pursue an educated choice on which one is appropriate for you.

Citi Double Cash Card

Best for: Cash Back Enthusiasts

The Citi Double Cash Card is one of the top cash back credit cards available. It offers a straightforward earning structure:

- 2% Cash Back: 2% Money Back: Procure 1% when you make a buy and an extra 1% when you pay for those buys.

- No Classifications: Not at all like other money back cards that expect you to actuate classifications, the Citi Twofold Money Card offers predictable money back on all buys.

Pros:

- High cash back rate with no caps.

- No annual fee.

- Easy cash back redemption options.

Cons:

- No bonus categories.

- Foreign transaction fees apply.

Citi Premier® Card

Best for: Travel Rewards

On the off chance that you’re an incessant explorer, the Citi Premier® Card offers critical prizes for your movement and ordinary spending:

- 3X Points: Procure 3 focuses per dollar on air travel, lodgings, and eating.

- 2X Points: Procure 2 focuses per dollar on amusement.

- 1X Point: Procure 1 point for each dollar on any remaining buys.

- Sign-Up Bonus: Procure a liberal sign-up reward in the event that you meet the spending necessity inside the initial three months.

Pros:

- High rewards rate on travel and dining.

- No foreign transaction fees.

- Access to Citi ThankYou® Rewards program.

Cons:

- $95 annual fee.

- Rewards redemption can be complex.

Citi Rewards+® Card

Best for: Everyday Spending

The Citi Rewards+® Card is great for the people who need to augment awards on regular buys:

- 2X Points: Acquire 2 points per dollar at grocery stores and service stations for the first $6,000 each year, then 1 point for every dollar from there on.

- 1X Point: Procure 1 point for every dollar on any remaining buys.

- Round Up Feature: All buys gather together to the closest 10 places, so even a little buy procures more.

Pros:

- No annual fee.

- Points rounding up boosts earning potential.

- 10% points back for the first 100,000 ThankYou® Points you redeem per year.

Cons:

- Cap on 2X points earning.

- Foreign transaction fees apply.

Citi Simplicity® Card

Best for: Balance Transfers

For those hoping to settle existing obligation, the Citi Simplicity® Card offers phenomenal equilibrium move highlights:

- 0% Intro APR: Appreciate 0% introduction APR on balance moves for a long time and on buys for a considerable length of time (then, at that point, the standard variable APR applies).

- No Late Fees or Penalty Rates: This card has no late expenses, no punishment rates, and no yearly expense, making it extremely sympathetic for the individuals who might miss an installment sometimes.

Pros:

- Long 0% intro APR period.

- No late fees or penalty APR.

- No annual fee.

Cons:

- No rewards program.

- Balance transfer fee applies.

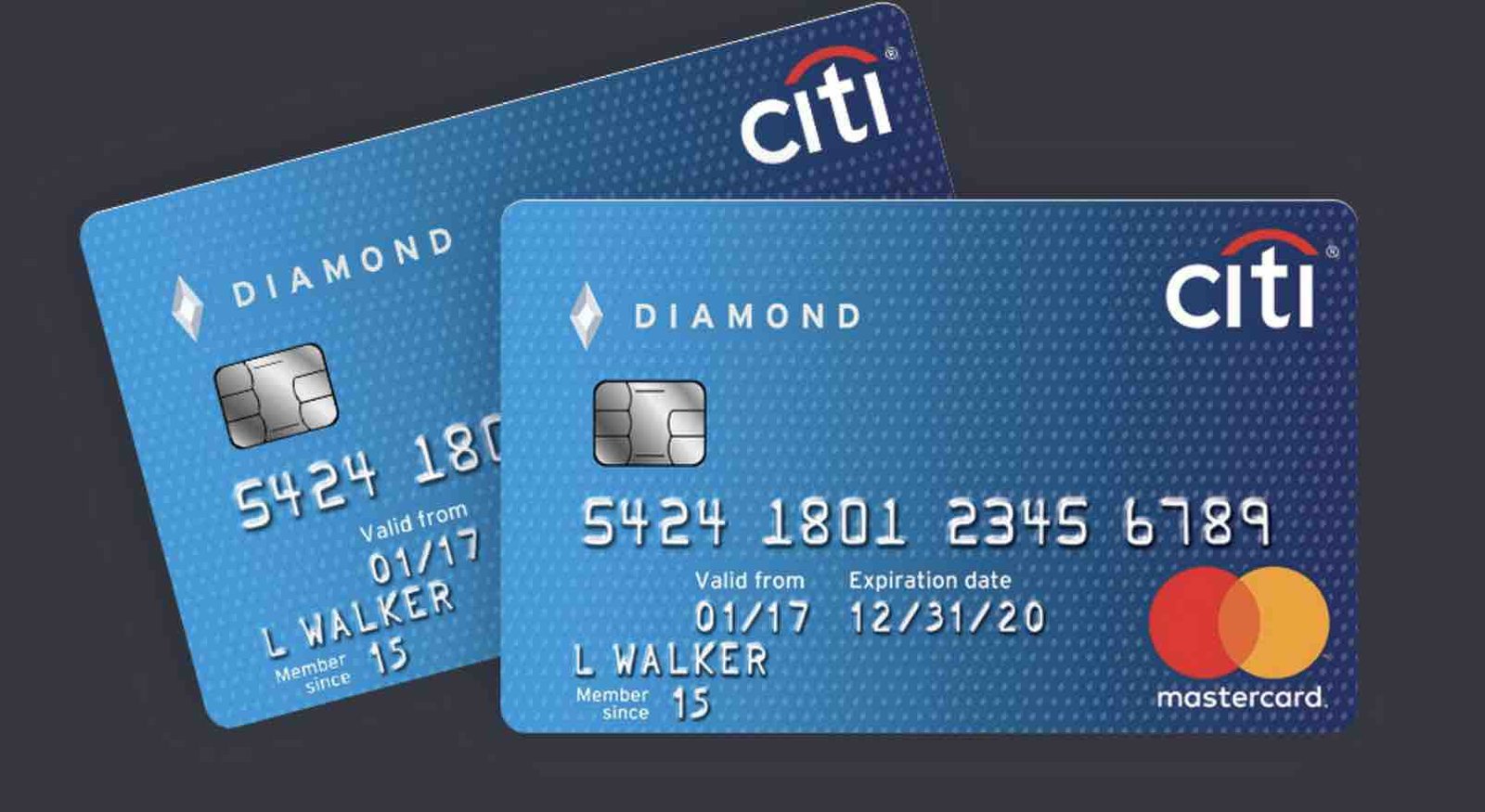

Citi® Diamond Preferred® Card

Best for: Low Interest

The Citi® Jewel Preferred® Card is intended for the people who need a low financing cost on buys and balance moves:

- 0% Intro APR: Appreciate 0% introduction APR on balance moves for quite some time and on buys for quite some time (then the standard variable APR applies).

- Low Variable APR: After the introduction period, the card offers a cutthroat variable APR in view of your financial soundness.

Pros:

- Long 0% intro APR period.

- Competitive ongoing APR.

- No annual fee.

Cons:

- No rewards program.

- Balance transfer fee applies.

Conclusion

Picking the right Citi Mastercard relies upon your individual monetary objectives and ways of managing money. Assuming money back is your need, the Citi Twofold Money Card offers one of the greatest rates that anyone could hope to find. For explorers, the Citi Premier® Card gives significant rewards and travel benefits. The Citi Rewards+® Card is perfect for ordinary enjoying with its remarkable gather together element. Assuming you’re centered around settling obligation, the Citi Simplicity® Card and Citi® Precious stone Preferred® Card offer long 0% introduction APR periods and low continuous loan costs.

By understanding the highlights and advantages of each card, you can choose the Citi Visa that best meets your requirements and assists you with accomplishing your monetary goals.