Introduction

In the speedy universe of digital money exchanging, crypto scalping has arisen as a famous strategy for dealers hoping to create fast gains. In contrast to long haul speculation methodologies, scalping centers around catching little cost developments in a brief period. This technique requires accuracy, speed, and a decent comprehension of market patterns. Whenever done accurately, crypto scalping candle can be a productive endeavor. Here is a gander at what crypto scalping is, the reason it’s famous, and the top systems for expanding gains.

What is Crypto Scalping?

Crypto scalping is a short-term trading strategy system pointed toward benefitting from little cost vacillations in digital money markets. Brokers make various speedy exchanges over the course of the day, exploiting minor cost developments in profoundly fluid resources. Hawkers regularly depend on specialized investigation, graphs, and exchanging bots to execute exchanges quickly, limiting openness to showcase instability. This quick moving methodology requires accuracy and discipline, making it well known among experienced crypto dealers looking for steady, little benefits. Crypto scalping is great for those hoping to exploit market failures without holding resources for extensive stretches.

Why Scalping?

Scalping is attractive because:

- Low Risk Exposure: Since trades are closed quickly, the exposure to market risk is limited.

- Frequent Opportunities: Scalpers can take advantage of multiple trading opportunities throughout the day.

- Capital Efficiency: Scalpers often use leverage to magnify small price changes, potentially increasing returns.

Top Crypto Scalping Strategies

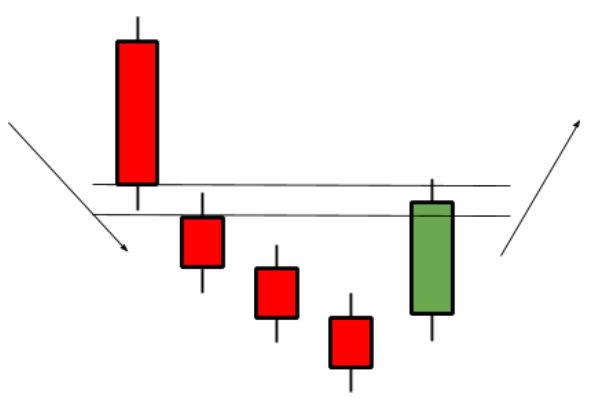

1. Range Trading

Range trading is one of the easiest types of scalping. In range exchanging, a dealer searches for resources that move between a characterized high and low sticker cost (the reach). The objective is to purchase close to the help level (the depressed spot) and sell close to the obstruction level (the high point). Hawkers frequently utilize specialized pointers like the General Strength File (RSI) to recognize overbought or oversold conditions.

Key Tip: Focus on assets with a consistent trading range and high liquidity to ensure smooth trade execution.

2. Moving Averages Strategy

Moving averages (MA) are essential tools for scalpers. This strategy involves analyzing short-term moving averages, such as the 5-minute and 15-minute charts. When the short-term MA crosses above the long-term MA, it’s a signal to buy. Conversely, if the short-term MA falls below the long-term MA, it indicates a selling opportunity.

Key Tip: Combine moving averages with other indicators like the MACD (Moving Average Convergence Divergence) for more reliable signals. and avoid crypto scam.

3. Market Making

Market making involves placing buy and sell orders at different price levels, aiming to profit from the bid-ask spread. Scalpers act as market makers by continuously buying and selling assets at slightly different prices. This strategy works best in highly liquid markets where there are tight spreads between the bid and ask prices.

Key Tip: To be successful, this strategy requires access to a trading platform that offers low transaction fees, as frequent trades can quickly add up.

4. Breakout Trading

Breakout trading is another popular scalping strategy that focuses on significant price movements. When the price of an asset breaks through a resistance level or drops below a support level, it often leads to rapid price movements. Scalpers look to capitalize on these breakouts by entering a trade as soon as the price breaks out and exiting once the price stabilizes.

Key Tip: Use volume indicators to confirm breakouts, as higher volume often accompanies genuine breakouts.

5. Stochastic Oscillator Strategy

The stochastic oscillator is a momentum indicator that compares an asset’s closing price to its price range over a specific period. When the stochastic oscillator indicates that an asset is overbought (above 80) or oversold (below 20), scalpers can use this information to enter trades. Scalpers buy when the oscillator crosses the oversold threshold and sell when it crosses the overbought threshold.

Key Tip: Combine the stochastic oscillator with other momentum indicators to reduce the chances of false signals.

Risks of Crypto Scalping

While crypto scalping can be profitable, it comes with several risks:

- Transaction Fees: High-frequency trading can lead to substantial transaction fees, especially in less liquid markets.

- Market Volatility: Cryptocurrencies are notoriously volatile, and even small price swings can result in losses.

- Emotional Stress: Scalping requires constant monitoring of the market, which can be mentally taxing.

Final Thoughts

Crypto scalping is a suitable strategy for the individuals who favor transient exchanging and have the discipline to execute exchanges rapidly and effectively. Notwithstanding, it requires crypto wallets major areas of strength for an of the market, specialized investigation, and the capacity to really oversee risk. By using the right instruments and procedures, crypto scalping can prompt predictable, yet little, benefits that accumulate after some time.