Introduction

candlestick pattern assume a vital part in technical analysis for stock trading. One of the examples that frequently flags a potential market inversion is the Tweezer Top candlestick pattern In this blog, we’ll bring a profound plunge into the Tweezer Top example, how it works, and how merchants can utilize it to further develop their exchanging choices.

What is the Tweezer Top Candle Example?

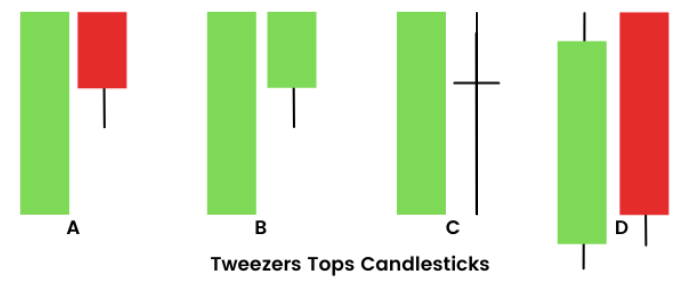

The Tweezer Top is a negative inversion design that happens after an upturn. It is comprised of two candles, where both the high marks of the candles are at or close to a similar level. This example proposes that purchasers are losing force and dealers are assuming control over, flagging a possible inversion in the cost development.

how to trade Tweezer Top patterns

To trade the Tweezer Top pattern effectively, first confirm that the pattern appears after a sustained uptrend. Once identified, consider entering a short position when the second (bearish) candlestick forms, signaling a potential reversal. It’s essential to place a stop-loss just above the high of the Tweezer Top to manage risk in case the price moves higher. Traders should set profit targets at recent support levels or use Fibonacci retracement levels for guidance. Always look for additional confirmation from other technical indicators, such as volume or moving averages, before executing the trade.

Key Characteristics:

- Two Candles: The Tweezer Top consists of two candlesticks, usually one bullish and one bearish.

- Equal Highs: Both candlesticks have nearly the same high, indicating resistance at that price level.

- Reversal Indicator: This pattern usually occurs at the top of an uptrend and signals a possible bearish reversal.

Understanding Tweezer Top with an Example

Imagine a stock that has been trending upward for several days. On Day 1, a bullish candle forms, indicating continued buying pressure. However, on Day 2, a bearish candle forms, but the high point is the same as that of the previous day. This is the Tweezer Top pattern. It shows that buyers tried to push the stock higher but failed to break above the high of Day 1, suggesting a shift in sentiment.

How to Identify a Tweezer Top Pattern?

To accurately spot a Tweezer Top, follow these steps:

- Uptrend: Ensure the pattern occurs after a sustained uptrend.

- Check for Two Candles: Look for two candlesticks with nearly identical high points.

- First Candle: Bullish (indicating strong buying).

- Second Candle: Bearish (indicating selling pressure).

- Confirm Reversal Signals: Watch for additional technical indicators like a drop in volume or other bearish patterns (e.g., RSI overbought levels) to confirm the Tweezer Top.

Trading the Tweezer Top Candlestick Pattern

Using the Tweezer Top for trading requires a well-thought-out strategy. Here’s how to trade this pattern effectively:

1. Enter Short Positions

Once a Tweezer Top is confirmed, many traders consider entering a short position. The rationale is that the equal highs signal a potential reversal, so the price is likely to drop in the short term.

2. Stop-Loss Placement

Risk management is essential. Place a stop-loss above the high of the Tweezer Top formation. This ensures that if the price breaks above the high, the trade is exited to minimize losses.

3. Set Targets

Set a profit target based on the stock’s recent support levels or by using Fibonacci retracement levels. A common practice is to aim for a 1:2 or 1:3 risk-reward ratio.

Common Pitfalls When Trading the Tweezer Top

While the Tweezer Top is a powerful pattern, it’s not without its challenges. Here are some common mistakes traders should avoid:

- Ignoring Volume: A Tweezer Top with decreasing volume adds more confidence to the reversal. Always check the volume to confirm market sentiment.

- Misinterpreting the Pattern: Ensure that both highs are nearly identical. Sometimes traders mistake two consecutive bearish candles with different highs for a Tweezer Top.

- Not Waiting for Confirmation: Jumping into a trade without additional confirmation can lead to losses. Look for other technical indicators, such as moving averages or momentum oscillators, to confirm the reversal.

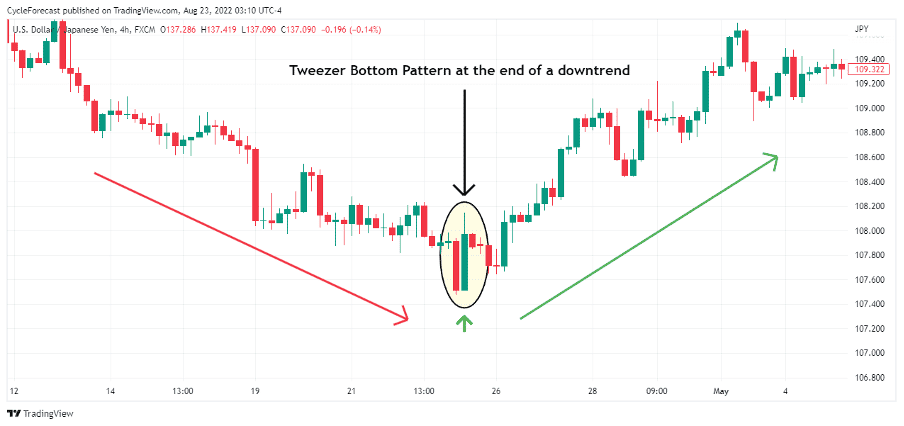

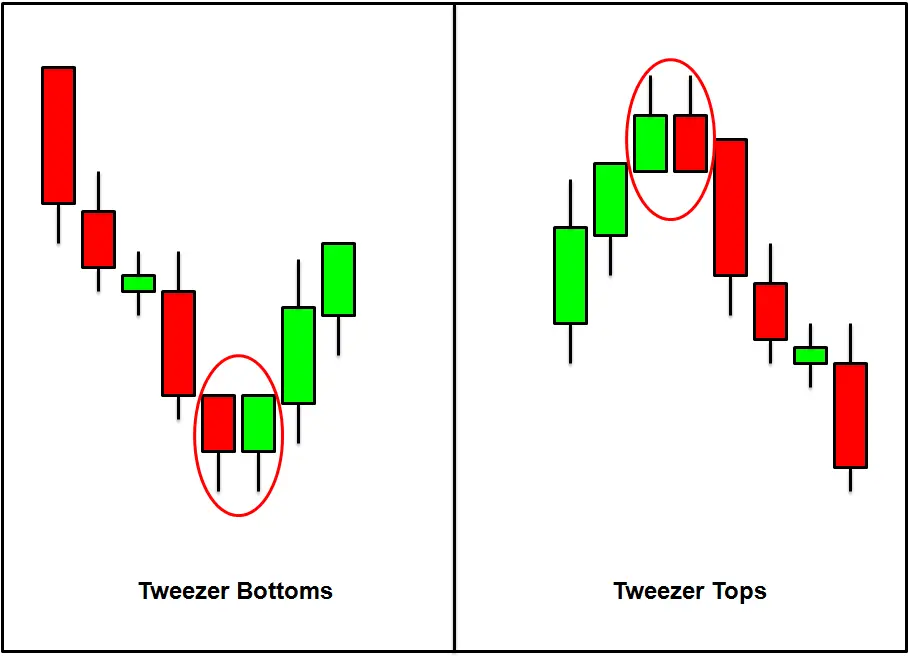

Tweezer Top vs. Tweezer Bottom

While this blog centers around the Tweezer Top, it’s vital to take note of that there’s a relating Tweezer Base example. While the Tweezer Top signals a negative inversion toward the finish of an upswing, the Tweezer Base demonstrates a bullish inversion toward the finish of a downtrend. The two examples share comparable attributes however signal inverse market headings

Conclusion

The Tweezer Top candlestick pattern is a dependable indicator for traders looking to benefit from pattern inversions. By understanding its arrangement and affirming the inversion with other specialized apparatuses, dealers can actually utilize this example to further develop their exchanging methodology. As usual, risk the board is critical, and each exchange ought to be painstakingly arranged with stop-loss and profit targets.

1 thought on ““How to Trade with the Tweezer Top Candlestick Pattern””