Managing multiple debts can feel overwhelming, especially when juggling various interest rates and payment deadlines. If you’re struggling to keep up, a debt consolidation loan could be the financial lifeline you need. In this article, we’ll explore the top five benefits of a debt consolidation loan that you simply can’t ignore.

Understanding Debt Consolidation Loans

A debt consolidation loan is a type of financing where you combine multiple debts into a single loan with a fixed interest rate and monthly payment. This approach simplifies debt management, making it easier to stay on top of your finances. Before diving into the benefits, let’s take a closer look at how debt consolidation works.

Benefit 1: Simplified Finances

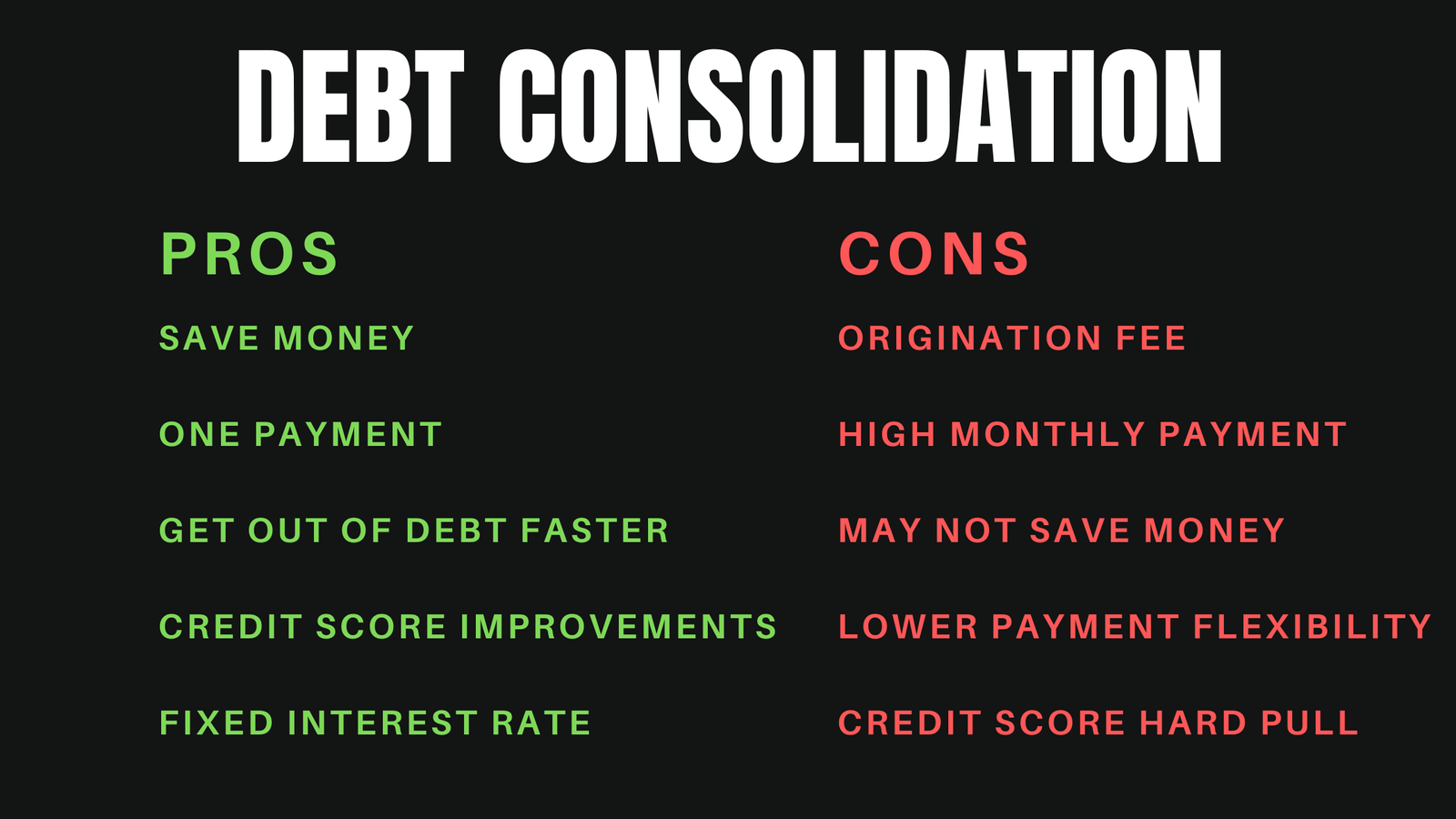

One of the most immediate benefits of a debt consolidation loan is the simplification of your financial life. Instead of keeping track of several debt accounts, you’ll have only one monthly payment to make. This can significantly reduce the stress associated with managing multiple bills.

- Single Payment: Consolidating debts means you make only one payment per month, reducing the risk of missed payments and late fees.

- Unified Interest Rate: With a debt consolidation loan, you lock in a single interest rate, making it easier to predict your monthly expenses.

- Streamlined Budgeting: A single payment helps you create a more manageable budget, giving you a clearer picture of your financial health.

Benefit 2: Lower Interest Rates

Another compelling advantage of debt consolidation loans is the potential for lower interest rates. If your current debts carry high-interest rates, consolidating them can save you a significant amount of money over time.

- Interest Rate Comparison: Debt consolidation loans often offer lower interest rates than credit cards or personal loans.

- Savings Calculation: By consolidating high-interest debts into a lower-rate loan, you can reduce the total amount of interest paid over the life of the loan.

- Fixed Rate Stability: A fixed interest rate ensures your payments remain consistent, protecting you from rate hikes in the future.

Benefit 3: Improved Credit Score

Consolidating your debts can also positively impact your credit score, which is crucial for your overall financial well-being. Here’s how:

- Reduced Credit Utilization: By paying off multiple credit cards with a consolidation loan, your credit utilization ratio decreases, which can boost your credit score.

- Fewer Missed Payments: Simplified payments reduce the likelihood of missed or late payments, which can negatively affect your credit score.

- Long-Term Credit Health: Consistent, on-time payments on your consolidation loan demonstrate responsible credit behavior, enhancing your credit profile over time.

Benefit 4: Stress Reduction

The mental and emotional toll of managing multiple debts cannot be underestimated. Debt consolidation can alleviate much of this stress by simplifying your financial obligations.

- Peace of Mind: Knowing you have only one payment to make each month can provide significant peace of mind.

- Reduced Anxiety: Managing debt effectively can reduce financial anxiety and improve your overall quality of life.

- Financial Control: A structured repayment plan gives you a sense of control over your financial future, reducing feelings of helplessness or frustration.

Benefit 5: Faster Debt Repayment

Lastly, debt consolidation loans can help you pay off your debts faster. By consolidating your debts into a single loan, you may qualify for better repayment terms that allow you to become debt-free sooner.

- Shorter Loan Terms: Many debt consolidation loans offer shorter repayment periods, which means you can pay off your debt quicker.

- Focused Repayment: With only one loan to focus on, it’s easier to develop a repayment strategy and stick to it.

- Debt-Free Future: Accelerated debt repayment means you can achieve financial freedom sooner, opening up new opportunities for saving and investing.

Conclusion

Debt consolidation loans offer a multitude of benefits that can significantly improve your financial situation. From simplifying your finances to reducing stress and improving your credit score, these loans provide a clear path towards financial stability and freedom. If you’re struggling with multiple debts, consider the advantages of a debt consolidation loan to streamline your payments and save money in the long run.

FAQs

- What is a debt consolidation loan? A debt consolidation loan combines multiple debts into a single loan with one monthly payment and a fixed interest rate, simplifying debt management.

- How does a debt consolidation loan lower interest rates? By consolidating high-interest debts into a single loan with a lower interest rate, you can reduce the total amount of interest paid over time

- Can a debt consolidation loan improve my credit score? Yes, by reducing your credit utilization ratio and making consistent, on-time payments, a debt consolidation loan can positively impact your credit score.

- What types of debt can be consolidated? Debts such as credit cards, personal loans, and medical bills can often be consolidated into a single loan.

- Are there any risks to debt consolidation loans? While beneficial, debt consolidation loans require discipline. If you continue to accumulate new debt, you may worsen your financial situation.

- How do I choose the best debt consolidation loan? Compare interest rates, loan terms, fees, and lender reputation. It’s essential to select a loan that fits your financial situation and repayment capabilities.

1 thought on “Top 5 Benefits of a Debt Consolidation Loan 2024 You Can’t Ignore”